Evolution of Screen Bias in the Airline Industry

The concept of “screen bias” in the airline industry, initially seen with Computer Reservation Systems (CRS), has evolved in the digital age, particularly with Online Travel Agencies (OTAs) and Metasearch engines. Originally, “screen bias” described the practice where airlines owning CRS systems would give preferential display to their flights over those of competitors, significantly affecting booking decisions.

Modern Screen Bias

Today, airlines and OTAs engage in a complex relationship, where flight rankings on these platforms can greatly influence customer choices and booking behavior.

The Problem: Conflicting Objectives

Airlines have traditionally been driven by Revenue Management actions, which aim to optimize load factors and yield. In contrast, OTAs and Metasearch engines are primarily focused on e-commerce conversions and maximizing the number of transactions. These divergent approaches can lead to conflicting objectives, exacerbating the issue of Modern Screen Bias. As a result, airlines may find their carefully crafted pricing strategies misaligned with their visibility on third-party platforms.

Need for Rank Management

Given the limited control airlines have over third-party platforms, there is a growing need for proactive monitoring and influence of their rankings. This shift in strategy is crucial for airlines to maintain their competitive edge in an increasingly digital marketplace. By implementing effective rank management, airlines can better align their revenue goals with their visibility on OTAs and Metasearch engines.

Solutions Available

Managing OTA and Metasearch rankings is a relatively new and complex challenge for airlines. The sheer volume of data involved – considering the number of routes, booking dates, and multiple platforms – makes manual monitoring impractical. It would require hundreds of thousands of clicks, meticulous data registration, and sophisticated database management with business intelligence visualizations.

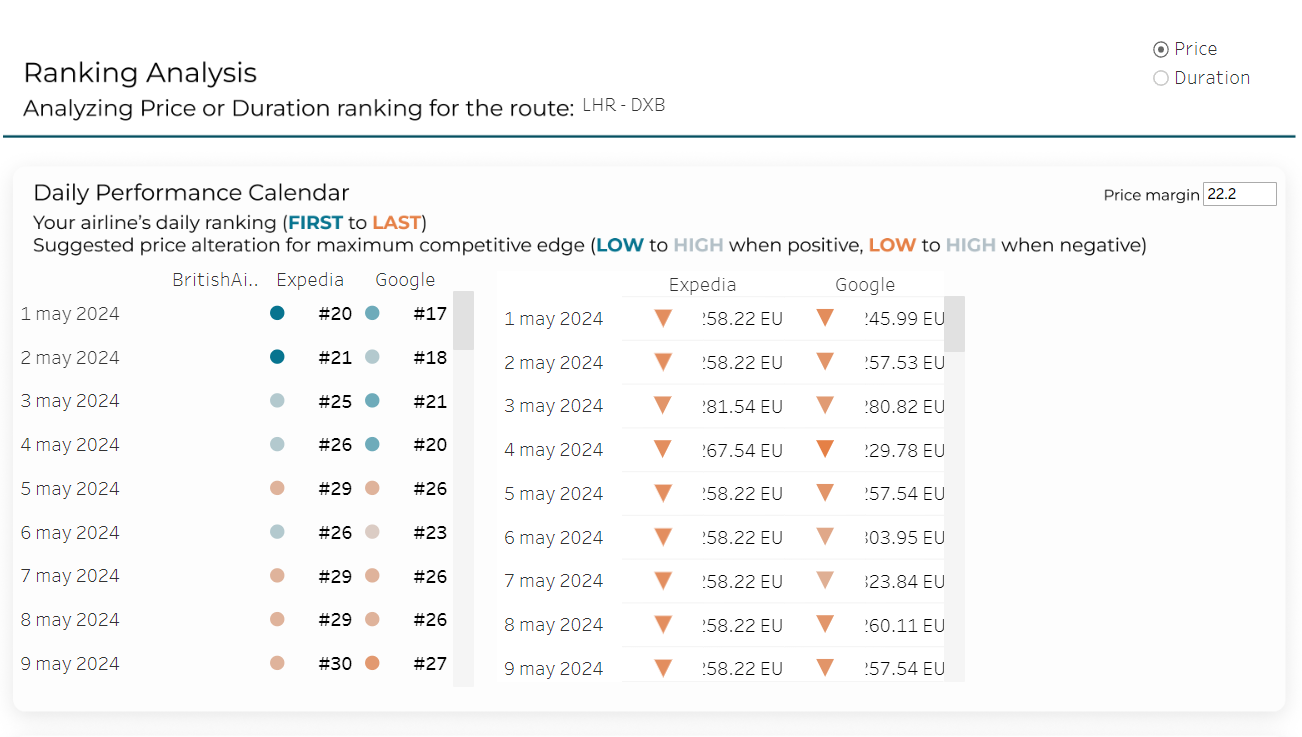

Alternatively, airlines can leverage third-party solutions like www.faretrack.ai. This platform’s recent addition to its library of airline competitive analysis tools provides aggregated charts that compile data from hundreds of thousands of daily price checks across numerous sources. The result is a set of simple-to-use fare rank insights that can significantly streamline the rank management process.

Key Capabilities for Rank Management

Effective rank management requires several key capabilities:

1. Automated monitoring system: Faretrack frequently extracts data from multiple OTAs and Metasearch engines on key airline-requested routes, ensuring up-to-date and comprehensive information.

2. Conversion of data into insightful charts: Faretrack’s library of dashboards includes a Fare Rank feature, which provides a visual interpretation of data, allowing airlines to quickly identify key areas for action.

3. Fare Rank fine-tuning: The platform goes beyond mere data presentation by suggesting specific pricing actions. These recommendations can help airlines either reduce prices to gain the top position or increase prices when there’s a significant gap between the first and second rank.

Summary

The evolution of screen bias in the airline industry has necessitated a new approach to revenue management that incorporates rank optimization on third-party platforms. By adopting rank management strategies and leveraging advanced tools like www.faretrack.ai, airlines can better navigate the complex digital landscape, aligning their revenue goals with their online visibility. This integrated approach allows airlines to maintain competitiveness, optimize revenue, and ensure their offerings are prominently displayed to potential customers across various digital channels. As the industry continues to evolve, the ability to effectively manage rankings will likely become an increasingly crucial component of successful airline revenue strategies.

Learn more about Faretrack’s capabilities here or download our free eBook “The Evolution of “Screen Bias” in the Airline Industry and Its Implications for Revenue Management”