Online Travel Agents (OTAs) have a symbiotic relationship with airlines. OTAs help airlines promote and sell their flights, and, in return, OTAs receive a commission. However, as beneficial as this relationship is for both parties, it is not always harmonious.

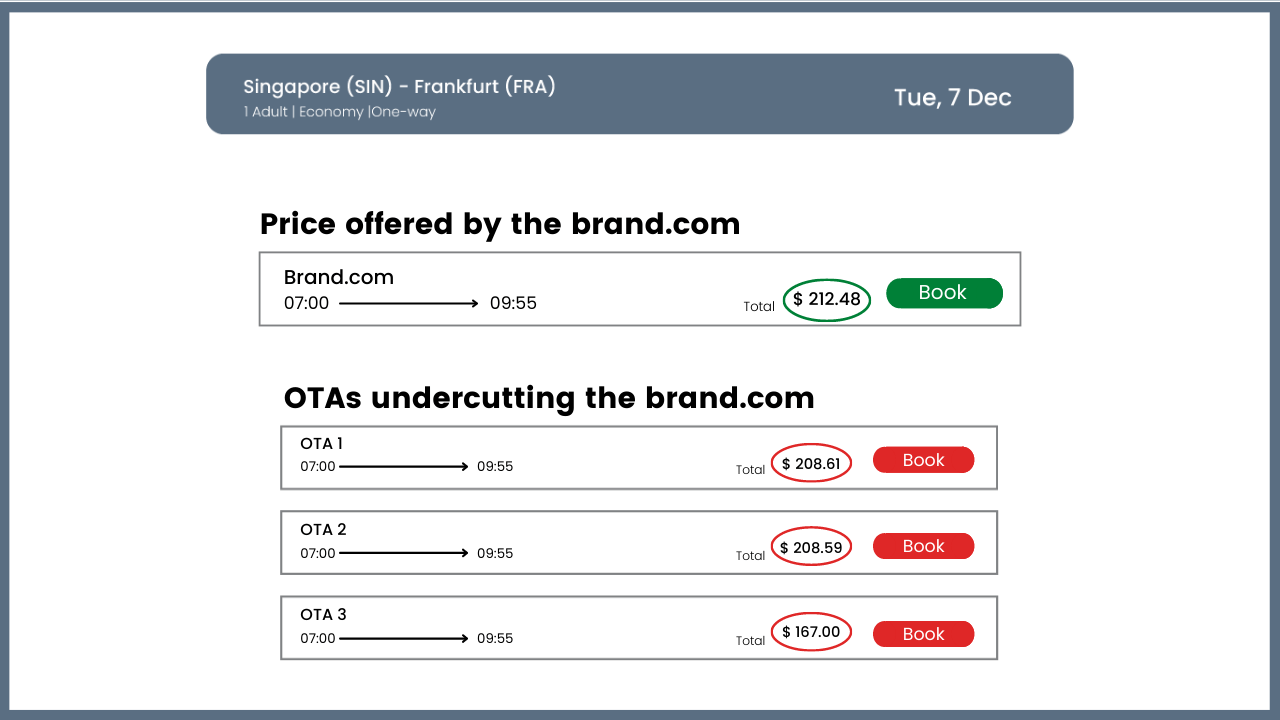

It is not uncommon for OTAs to reduce ticket prices, undercutting the brands in the process. Due to the pandemic, airline brands have suffered dramatic decreases in ticketing. OTA sales have also fallen and they are under pressure to generate revenue. Unfortunately, a portion of OTAs are doing that by actively undercutting brand prices.

Not all OTAs are undercutting; however, some OTAs routinely undercut airlines on their ticket prices. This practice of undercutting tickets is problematic for the airlines and for several reasons:

- Lost Confidence and Loyalty:

Customer loyalty is essential for businesses, and airlines are no different. Customer loyalty helps ensure customers continue to use the airline in the future, and loyalty programs can contribute significantly to overall revenue. Indeed, American Airlines reported $5.5 billion in revenue from loyalty programs in 2019. Not only can an airline secure a long-term revenue source from customers directly, but loyal customers are also more likely to recommend the airline to friends, family, and colleagues.

When OTAs undercut an airline, it appears that the airline is not being honest with its customers regarding their prices. The result is a potential loss of confidence in the airline, and customers might start using other airlines instead. Considering the figures above, it’s easy to see why an airline will be protective over its brand image.

- Lost Short-Term and Long-Term Revenue

If OTAs are undercutting airlines, then their customers willlikely choose to buy their ticket at a lower rate. Tickets purchased from OTAs represent a loss in revenue for the airlines because the OTA will take their commission from the sales. Revenue losses will occur for the airlines, including short-term losses from individual tickets bought and long-term losses as customers are trained to seek alternatives.

Tickets are not the only source of revenue for airlines; ancillaries also make a considerable contribution. While ancillaries like baggage fees, merchandise, and onboard food and drink will not be impacted; however, other ancillaries like vehicle hire, hotel booking, and even guided tours will be lost to the OTA.

- Information Loss

When a traveler buys tickets through an OTA because the airline was undercut, the airline also misses out on details such as the passenger’s email address and travel history. Missing out on such details means the airline loses valuable marketing opportunities such as upselling or enrolling passengers into loyalty reward programs that encourage future business interactions.

Information loss also means that airlines have less information regarding passenger preferences, making it harder for them to add value and establish/maintain customer loyalty.

Introducing Rate Parity

Rate Parity is a concept that helps to overcome the issues mentioned above. It’s quite a simple solution that involves OTAs and airlines agreeing that the OTA will not sell the airline’s tickets for less than the agreed amount. The result is potential customers will find the same price for a ticket regardless of where it is sold. Or, at least, that’s what the outcome is intended to be.

Unfortunately, not all OTAs follow the agreements. Indeed, a recent study by FareTrack has shown that OTAs are undercutting approximately 30% of flights. In some cases, fares are undercut by as much as 70%.

When OTAs do offer discounted fares, it is known as a rate parity violation. Discounts are offered in different ways, and OTAs employ different tactics to try to avoid airlines noticing.

- Deal Closers

OTAs will want to close as many sales as they can, and in some cases, closing a deal might mean reducing the price of a ticket or overall package. This will also sometimes include bulk discounts that can net significant profits for the OTA.

- Geo-Targeted Fares

Geo-targeting is offering different fares to consumers according to where they are geographically. Fares are offered at a lower rate based upon location, making them more affordable and in turn providing more revenue for the OTA. A user’s IP address is typically used to identify somebody’s location allowing geo-specific pricing to be offered.

- Changing Flight Numbers

Another tactic used by OTAs is to change the flight number when it is listed, making it all but impossible for the system to detect rate parity violations on the system at the time. When the flight is sold and the Passenger Name Record is issued, the flight number is changed to match the real flight number.

Changing the flight number in this way can lead to confusion, potentially damaging the airline’s reputation. Travelers will often blame the confusion on the airline unaware that the OTA was the cause of the problem.

Overcoming Rate Parity Violation Issues

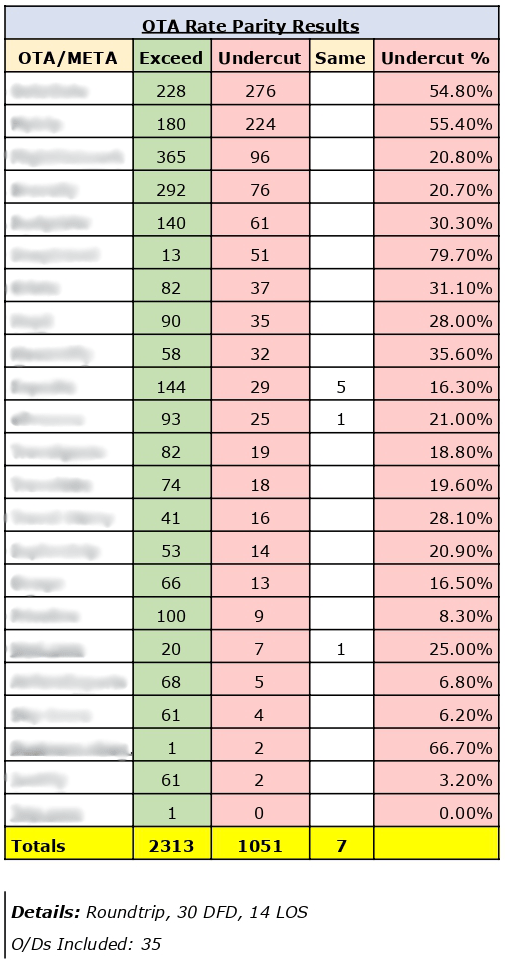

The main factor that makes it difficult for airlines to monitor and identify OTA parity violations is the sheer number of tickets being offered.

According to Statista, globally nearly 3.5 billion passengers will be flying in 2022. These numbers help to portray the headache that airlines have when it comes to monitoring airline prices. Imagine the volume of prices those consumers were presented as they made their purchase decision.

Such is the scale of the challenge that a FareTrack executive likened it to “searching for a lot of little needles in a very large haystack.”

OTAs are still a critical partner for airlines and contribute significantly to their revenue. Indeed, travel agents accounted for 44% of sales for airlines in 2019. Therefore, airlines need to be able to maintain positive relationships with OTAs while still ensuring that their tickets are sold fairly.

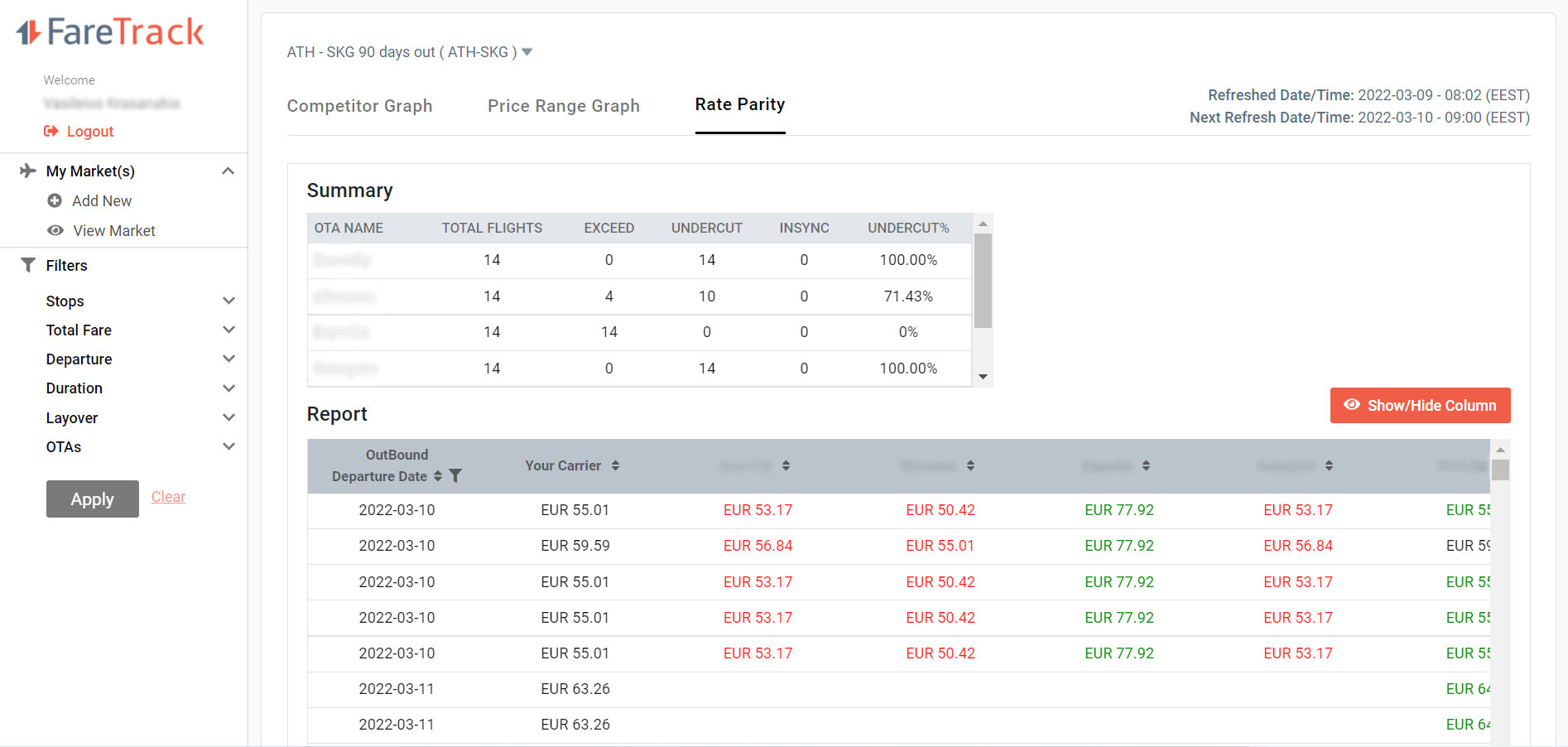

One solution to the problem is to use sophisticated Business Intelligence (BI) software capable of monitoring such large numbers of offered fares. Systems like FareTrack can constantly monitor the offered fares across numerous OTAs with little human input. With a powerful monitoring capability, BI platforms identify specific instances of undercutting by individual OTAs, helping airline managers react accordingly to protect their revenue and brand reputation.

Such a solution can do more than identify OTAs who are committing rate parity violations. The software can also provide fare analyses of rival airlines and monitor fare prices over time. Vast amounts of data can be compiled into intuitive graphs, giving managers the information they need to make impactful decisions.

With a system like FareTrack in place, airlines help protect their own interests in challenging times while also helping to maintain strong relationships with OTAs overall.

Conclusion

Airlines benefit greatly from OTAs, and vice versa. Rate parity agreements keep the relationship equal for both parties, but unfortunately, there’s always likely to be OTAs breaking parity for their own short-term gains. Such violations can cause short-term and long-term financial loss for the airline and a loss of consumer trust in the brand.

A solution is for airlines to use BI platforms like FareTrack that closely monitor fares and identify OTA rate parity violations. An airline can readily identify parity violations and address the issue with the OTAs directly with proof. BI platforms also give airline managers access to a range of other powerful features that benchmark competitive pricing opportunities and identify opportunities to optimize fares.